Digital Estate Planner: A Comprehensive Guide

A revolutionary App for Digital Estate Planning .

FREE Download. Why use the Inherrit app instead of Excel?

- Free download

- Easy to record and view details

- Easy to share with family

- Security & encryption

- Ease of use

- Everything in once place

- List key contacts

- List key documents

- Connect with inheritance tax experts

What are digital assets?

Digital assets refer to any electronic records or files that are stored online, on mobile devices, or on personal computers. These assets can hold value and can be bought, sold, stored, and traded online. Examples of digital assets that may need to be included in an estate plan include email accounts, social media accounts, online banking accounts, online subscription-based accounts, photos saved online or on the cloud, and loyalty program benefits. It is important to consider these assets in your overall estate planning strategy to ensure that your digital legacy is protected and that your assets are distributed according to your wishes.

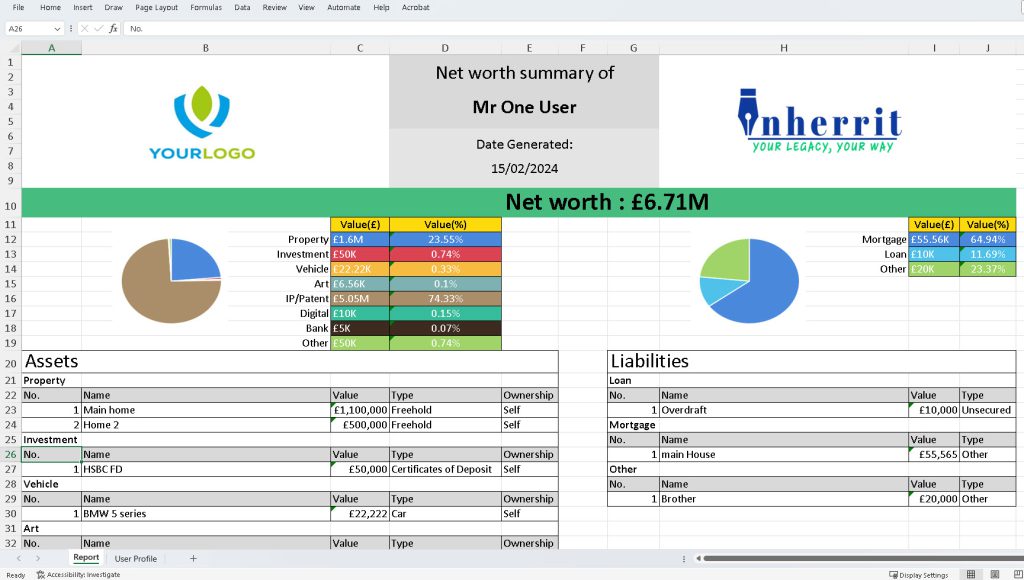

Click here to download the Excel Template for Digital Estate Planner

Or download the app

|

|

Why is digital estate planning important?

1. Digital assets have become increasingly valuable and important.

Digital assets are becoming increasingly important in today’s world and need to be included in estate planning. Digital assets include anything that can be stored digitally and transmitted electronically, such as photos, videos, audio files, online accounts, cryptocurrencies, and non-fungible tokens. These assets hold value and can be bought, sold, stored, and traded online just like physical assets. It’s important to protect these assets and ensure they are included in your estate plan because without proper planning, your beneficiaries may be unable to access them, and they risk not receiving the entirety of the intended inheritance.

2. Most people have some form of digital asset, even if it is just an email account.

Almost everyone has some form of digital asset, whether it’s an email account, social media profile, or online banking account but many people fail to realise the importance of planning for these digital assets in their estate plans. Failing to plan for these assets can lead to confusion, loss of important information, and even legal battles after one’s passing.

For example, imagine leaving behind an online business that generates income but not having a plan in place for its management and distribution. The business could be lost or taken over by someone who has no idea how to run it, resulting in the loss of income for your loved ones. Another example would be leaving behind a sentimental collection of digital photos that are lost forever because no one knows how to access them. Digital asset estate planning can prevent these scenarios and provide peace of mind. It involves taking inventory of all your digital assets and creating a plan for their management and distribution. With a plan in place, you can rest assured that your digital legacy will be preserved and managed according to your wishes.

Whether you have a few digital accounts or a large online presence, it’s important to take the time to plan for your digital assets.

3. Most people do not have a clear plan for how to deal with their digital assets after death.

Without a digital estate plan, there is a risk of confusion among family and friends, disputes over ownership, and even legal issues regarding access to digital assets. Your loved ones may not know what websites you use or where to find the logins and passwords. Therefore, it’s vital to ensure that they are adequately protected and managed by creating a clear plan for digital asset estate planning. Taking the time to create a digital estate plan can provide peace of mind to you and your loved ones, ensuring that your digital legacy is handled according to your wishes.

4. Digital assets can be valuable in terms of both monetary value and sentimentality.

Digital assets have become an integral part of our lives, and their value cannot be underestimated. They hold both monetary and sentimental value, which makes it crucial to consider them while creating an estate plan. Digital assets like cryptocurrencies and NFT can be worth a significant amount of money and need to be protected. Without proper digital asset estate planning, these valuable assets may be lost or inaccessible, causing financial losses for loved ones.

In terms of sentimental value, digital assets include personal photos, videos, and other memories that are stored online or in the cloud. These assets may not hold any monetary value, but they are priceless in terms of sentimental value. Losing access to these assets can be devastating for loved ones, especially if they are unable to retrieve them after your passing. Digital asset estate planning ensures that your sentimental digital assets are preserved and passed down to your loved ones, providing them with a lasting memory of you.

5. Having a plan for how to deal with digital assets can save time and reduce stress after death.

Dealing with the aftermath of a loved one’s passing is already an emotionally charged and stressful time. Uncertainty and confusion around handling their digital assets can compound this stress considerably. Having a well-outlined plan for these digital assets is thus incredibly valuable. A comprehensive digital asset plan can significantly streamline the process of settling an estate, saving time that would otherwise be spent in trying to uncover and access various accounts and assets. A clear plan provides a roadmap, guiding executors and beneficiaries through the digital landscape that many of us leave behind, thereby reducing the risk of overlooked or lost assets.

Having a digital estate plan also provides peace of mind for the individual planning their estate. They can rest assured knowing that their digital legacy will be handled in a way that aligns with their wishes, alleviating potential stress or worry about what will happen to their digital assets after death.

6. There are risks associated with different digital assets – Deletion, Hacking, Lost forever, Falling into the wrong hands.

Digital assets carry unique risks. Many online platforms may delete accounts after a period of inactivity or upon the user’s death, causing valuable or sentimental content to be lost irretrievably. Digital assets can also be targets for hacking. Cybercriminals often seek out vulnerable accounts for financial gain, identity theft, or even simple malice, and the risk escalates if login details are inadequately secured. Another risk is the possibility of digital assets being lost forever, especially if they’re not correctly documented or if access information is misplaced. Such losses can be financially impactful and emotionally distressing. Without clear instructions or legally enforceable wills, assets could be misappropriated or mishandled, leading to undesirable consequences.

7. There are a variety of tools available to help with digital asset estate planning.

There are several tools available for digital asset estate planning, and it is important to choose the one that suits your needs best. From paid services to simple software like Word, Excel and even simple pen and paper can go a long way in helping you to plan your digital asset estate planning. Read our article on tools for digital asset estate planning.

Quick Checklist for Digital Asset Estate Planning

| Step | Action |

| 1 | Identify all digital assets (online accounts, digital files, social media, digital currencies, etc.). |

| 2 | List all usernames and passwords for these digital assets. |

| 3 | Review terms of service for each digital platform. |

| 4 | Decide who should have access to each asset after your death. |

| 5 | Write down your wishes for each asset (i.e., delete, memorialise, transfer ownership, etc.). |

| 6 | Appoint a digital executor to handle your digital estate. |

| 7 | Securely store the list of digital assets and login credentials. |

| 8 | Consult with a solicitor to ensure your wishes are legally binding. |

| 9 | Regularly update your digital assets list as you create new accounts or as policies change. |

| 10 | Discuss your digital estate plan with your executor and loved ones. |

What should be included in the digital asset inventory list?

- Email Accounts

- Passwords

- Social Media Accounts

- Computer Files

- USB Drives

- Cryptocurrencies

- Gaming Accounts

- Online Shops

- Warranty Information

- Smartphones

- Tablet Computers

- Photography and Videos

- Email Archives

- Website Domains

- Online Banking Accounts

- Consoles and Gaming Systems

- Text Messages

- Cloud Storage Accounts

- User Accounts for Online Services

- Testaments, Wills and Last Wishes